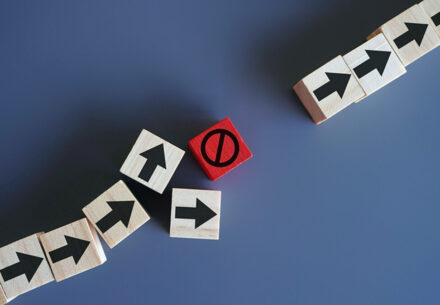

When Is It Time to Change Your Business Structure?

Choosing a business structure is one of the first major decisions an entrepreneur makes. And we want to stress...

Read More

Choosing a business structure is one of the first major decisions an entrepreneur makes. And we want to stress...

Read More

Payroll is one of the most critical operational functions in any business. It directly affects employee morale, regulatory compliance...

Read More

Bookkeeping is a crucial business task. Accurate financial records give you the insights you need to make smarter decisions,...

Read More

Cleaning up your books ensures accurate financial reporting, helps you maximize deductions and sets you up for a smoother...

Read More

You’ve probably heard the age-old pricing strategy advice: “Charge what you’re worth.” It’s good advice … but it’s not...

Read More

Paying bills manually — writing checks, scheduling one-off online payments and updating spreadsheets — feels like the ultimate exercise...

Read More

What business owner wouldn’t want the “problem” of growing too big, too fast? Rapid growth is is a good...

Read More

We say it often, but it bears repeating: For many small business owners, every dollar counts. Yet in their...

Read More

When you launched your business, doing the books in-house (or even on your own) made perfect sense. It was...

Read More

One of the biggest surprises entrepreneurs find when balancing the books is that there’s more than one way to...

Read More