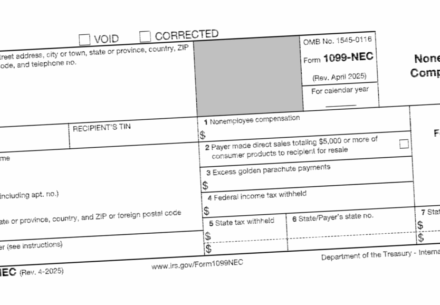

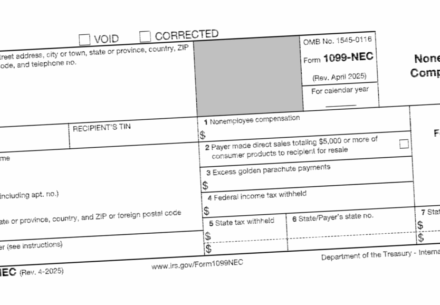

How Businesses Must Handle 1099s for Contractors & Freelancers

If your business relies on contractors and freelancers, you’re not alone. Millions of Americans working independently help companies fill...

Read More

If your business relies on contractors and freelancers, you’re not alone. Millions of Americans working independently help companies fill...

Read More

Bookkeeping is a crucial business task. Accurate financial records give you the insights you need to make smarter decisions,...

Read More

Cleaning up your books ensures accurate financial reporting, helps you maximize deductions and sets you up for a smoother...

Read More

You’re the proud owner of a growing small or midsize business. You need capital, and fortunately, you have a...

Read More

You’ve probably heard the age-old pricing strategy advice: “Charge what you’re worth.” It’s good advice … but it’s not...

Read More

The rise of remote work has made it easier than ever to bring in a contractor to help with...

Read More

Paying bills manually — writing checks, scheduling one-off online payments and updating spreadsheets — feels like the ultimate exercise...

Read More

Big tax changes don’t come around every year, but when they do, they can be confusing, controversial and have...

Read More

Washington has just passed one of the most significant pieces of tax legislation in decades. The One Big Beautiful...

Read More

You’re a small business owner who needs funding. What’s the first source of capital that comes to mind? A...

Read More