Business Tax Changes Coming in 2024 (And Possibly Beyond)

The tax code is constantly in a state of flux, which is why staying compliant is such a headache. Every year, small business owners who do their own taxes have to catch up with the latest rule additions, phase-outs and expirations pertaining to deductions, credits and more.

Our advice? Don’t play catch-up — instead, be proactive. That means not just staying on top of the latest tax changes, but keeping an eye on potential tax discussions and decisions that could turn into new policy.

Thus, here in the early innings of 2024, we want to shine a light on both new tax policy taking effect this year, as well as tax changes that could be coming down the pike.

We’ll start by highlighting a couple important actual changes happening in 2024, then we’ll shift to a few tax proposals (both actual and proposed) that could come into the picture sooner rather than later.

2024 Changes

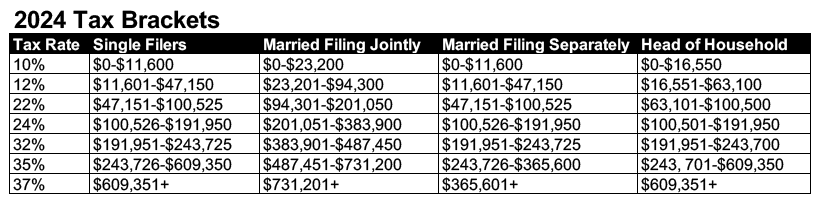

2024 Tax Brackets

First things first: The federal tax brackets have largely been expanded to reflect changes in inflation. Here’s a look at the 2024 tax brackets, which apply not just to individual taxpayers, but also several business structures, including sole proprietorships, partnerships and S corps.

2024 Retirement Plan Contribution Limits

If you contribute to a 401(k), 403(b) or a 457, or have employees who will, you’ll want to let them know that the 2024 contribution limit for those plans is $23,000. That’s up $500 from 2023.

(Note: Individual retirement account [IRA] limits were also raised by $500, from $6,500 in 2023 to $7,000 in 2024.)

Employee Retention Credit

This year marks the end of the Employee Retention Credit (ERC). The ERC was created early on in the COVID pandemic, as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which was signed into law in March 2020.

Businesses technically have until April 15, 2024, to claim the credit, though the IRS actually halted the processing of ERC claims in September 2023 amid an influx of claims due to ERC scams. But it’s possible the IRS could restart claims processing in 2024 before the April 15 deadline.

2024 Tax Discussions to Watch

TCJA Provisions

The Tax Cuts and Jobs Act of 2017 (TCJA) ushered in a number of business-friendly tax rules, but many weren’t permanent — several of them began to sunset over the past couple of years. However, lawmakers have plenty of interest in fully restoring several of these provisions, including:

- Accelerated Bonus Depreciation: The TCJA allowed businesses to claim 100% bonus depreciation (the “168(k) allowance”) for depreciable business assets in the year they were placed in service. This provision changed in 2022; in 2023, the allowance dropped to 80%, and it will shrink by 20 percentage points each year until it fully expires in 2027.

- Business Interest Deduction Limit: The TCJA limited the deduction for net business interest expense to a maximum of a taxpayer’s EBITDA (earnings before interest, taxes, depreciation and amortization). This provision changed in 2021; as of 2022, the 30% deduction is based only on EBIT (earnings before interest and taxes).

- R&D Amortization: The TCJA allowed businesses to deduct some research and development costs under section 174. This provision changed after 2021; as of 2022, those expenditures must be amortized over five years.

Lawmakers have been advocating for legislation that would reverse restrictions on these “Big Three” provisions.

Moore v. United States

A case currently being heard by the U.S. Supreme Court could very well blow a hole in America’s tax code.

The case stems from the TCJA, which imposed a deemed repatriation on accumulated foreign earnings that had previously been deferred. Charles G. Moore and Kathleen F. Moore, which owned an 11% share in an Indian company, saw a $15,000 increase in their 2017 tax liability as a result. They claimed the tax was unconstitutional; while a district course dismissed the case and the Ninth Circuit affirmed, the Supreme Court agreed to hear the case.

The case itself could have enormous ramifications — specifically as to whether Congress is able to tax unrealized income.

The Priority Guidance Plan

If you’re curious as to what the Treasury Department and Internal Revenue Service are focusing on in a given year, you can check out the Priority Guidance Plan (PGP) — a set of guidance projects that the Treasury and IRS want to address within a given year. The current PGP relates to projects to be addressed through June 30, 2024.

Let Us Keep Tabs on Taxes for You

Of course, small business owners have a lot on their plates. They typically don’t have time to keep up with the rapidly changing tax landscape — let alone look ahead to mere discussions and speculation on tax policy.

But if you have McManamon & Co. on your side, you don’t need to.

McManamon & Co. provides creative, innovative and proactive tax advice that keeps your company on Uncle Sam’s good side. Our tax strategies incorporate vigilance and forward planning to keep you in control of your tax situation. We routinely project upcoming tax liabilities and make recommendations to minimize and defer pending liabilities.

If you want to make sure your company is always prepared for what the IRS throws your way, call us at 440.892.8900 or contact us online.

Tags: McManamon & Co., small business, small business taxes, tax news, tax reform, taxes | Posted in McManamon & Co., small business, small business taxes