How Businesses Must Handle 1099s for Contractors & Freelancers

If your business relies on contractors and freelancers, you’re not alone. Millions of Americans working independently help companies fill talent gaps, scale operations or bring their specialized expertise to projects.

However, while independent contractors can bring agility and cost savings to your business, they also definitely bring their own unique tax-reporting requirements: specifically, IRS Form 1099.

Mismanaging 1099s can lead to strained contractor relationships, compliance headaches and even IRS penalties. You obviously want nothing to do with any of that, so let’s check out what small and midsized business owners need to know about handling 1099s the right way.

What Is Form 1099?

Form 1099 is an “information return” that reports certain types of income to the IRS.

The version most businesses encounter is Form 1099-NEC, which reports compensation of $600 or more paid to independent contractors, freelancers and/or vendors for services rendered. They need this form to properly file their taxes.

When Do You Need to Issue Form 1099-NEC?

You’ll generally need to issue a 1099-NEC if:

- You paid a non-employee (so, a freelancer or independent contractor) $600 or more during the year.

- The payment was for services, not for goods or products.

- The contractor is not incorporated as a C corporation or S corporation (with some exceptions).

- Payments were made in cash, check, or electronic transfers. (Credit card and PayPal payments are reported separately by payment platforms on Form 1099-K, which the platforms will issue.)

If you’re unsure whether someone should receive a 1099, start by confirming their tax status. This is where Form W-9 comes into play. Always request a completed W-9 from new contractors before they begin work. It provides you with the legal name, address, and taxpayer identification number (TIN) you’ll need to issue a 1099.

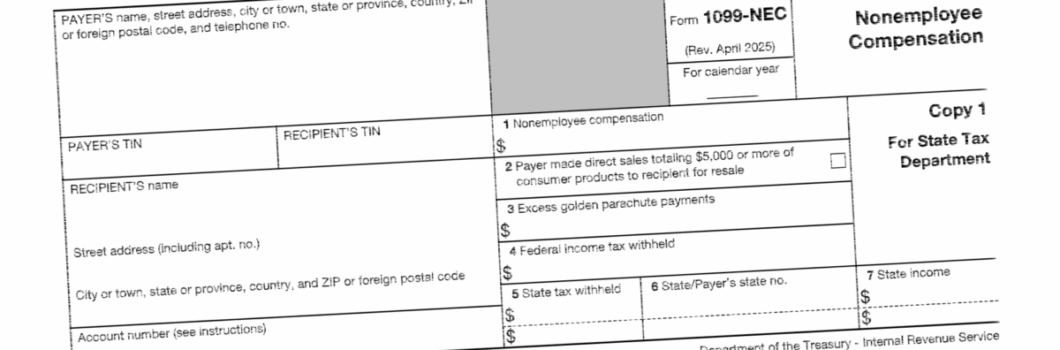

What Do You Need to Put on Form 1099-NEC?

You can see everything you’ll need to fill out by checking out the IRS’s PDF version of Form 1099-NEC, but among the key points:

- Payer’s name

- Payer’s address

- Payer’s phone number

- Payer’s tax identification number (TIN, usually your employer identification number)

- Recipient’s name

- Recipient’s address

- Recipient’s TIN (usually their Social Security number)

- Amount of employee compensation paid throughout the year.

Certain fields aren’t necessarily required. For instance, the IRS does not require “account number,” which is instead used by companies to help differentiate between 1099 forms if they’ve filed more than one for the same contractor in the same tax year.

Key 1099 Deadlines

Staying on top of deadlines is critical to avoiding costly IRS fines. Here are some important dates for 1099 issuance and filings:

- Jan. 31: Deadline to send copies of 1099-NEC forms to contractors and to file with the IRS (whether filing electronically or on paper).

- Feb. 28: Paper-filing deadline for most other 1099 forms (such as 1099-MISC).

- March 31: Electronic filing deadline for most other 1099 forms.

Note: Feb. 28 deadline applies even in leap years.

Unlike many IRS deadlines, there’s very little wiggle room here. Missing the Jan. 31 deadline for 1099-NEC can result in late-filing penalties, which can change by year.

For the 2025 tax year, the penalties for each late return are:

- Up to 30 days late: $60

- 31 days late through Aug. 1: $130

- After Aug. 1 or not filed: $330

- Intentional disregard: $660

You can check out penalties for other tax years at IRS.gov.

Electronic Filing Rules

The IRS strongly encourages electronic filing. In fact, if your business is filing 10 or more information returns (including W-2s and 1099s), you must file electronically. (This is cumulative, so if you file five W-2s and six 1099s, that’s 11 information returns, so you must e-file.) That said, even if you’re below the 10-form threshold, you’ll want to consider e-filing, which can help reduce errors, provide confirmation of receipt, and simplify recordkeeping.

The IRS has two platforms for e-filing 1099s:

- FIRE (Filing Information Returns Electronically)

- IRIS (IRS Information Return Intake System)

Both systems are supported as of this writing, but starting Dec. 1, 2027, IRIS will be the only allowable method.

The IRS FIRE (Filing Information Returns Electronically) system is the standard platform for submitting electronic 1099s. Some payroll software and accounting systems also integrate directly with the IRS to streamline this process. Even if you’re below the 10-form threshold, e-filing can reduce errors, provide confirmation of receipt, and simplify recordkeeping.

Best Practices for Stress-Free Compliance

If you’re issuing multiple 1099s each year, a proactive process can save you headaches:

- Onboard properly: Collect a signed W-9 before paying contractors.

- Track payments continuously: Use accounting software to flag contractors approaching the $600 threshold.

- Leverage automation: Many cloud accounting tools can generate 1099s at year-end with a few clicks.

- Verify details: Double-check TINs, names and addresses before filing to avoid rejected forms.

Ready to Simplify Your 1099 Filing?

Independent contractors can help your business stay lean and flexible — you just need to make sure you handle the reporting requirements.

McManamon & Co. is an accounting, tax, fraud, forensic and consulting firm that serves small and midsize businesses. We provide a variety of outsourced CFO and accounting services, including helping you manage contractor reporting obligations and setting up accounting systems that streamline 1099 processes.

Call us at 440.892.8900 or contact us online today to learn how we can help keep your business compliant and stress-free.

Tags: outsourced CFO, outsourcing your accounting, payroll, record-keeping, small business accounting, small business taxes, taxes | Posted in small business taxes