The Biggest Problems Small Businesses Face in 2020

2020 likely will go down as one of the most transformative years in American small business history, for all the wrong reasons. COVID-19 has turned into an existential problem for most small businesses. The pandemic has forced thousands to permanently close and still weighs heavily on countless more.

But it’s important to remember that the coronavirus isn’t the only problem small businesses face. In fact, there are hundreds of challenges to prosperously operating your own company — some collectively shared across most of the community, others more specific to geography or industry.

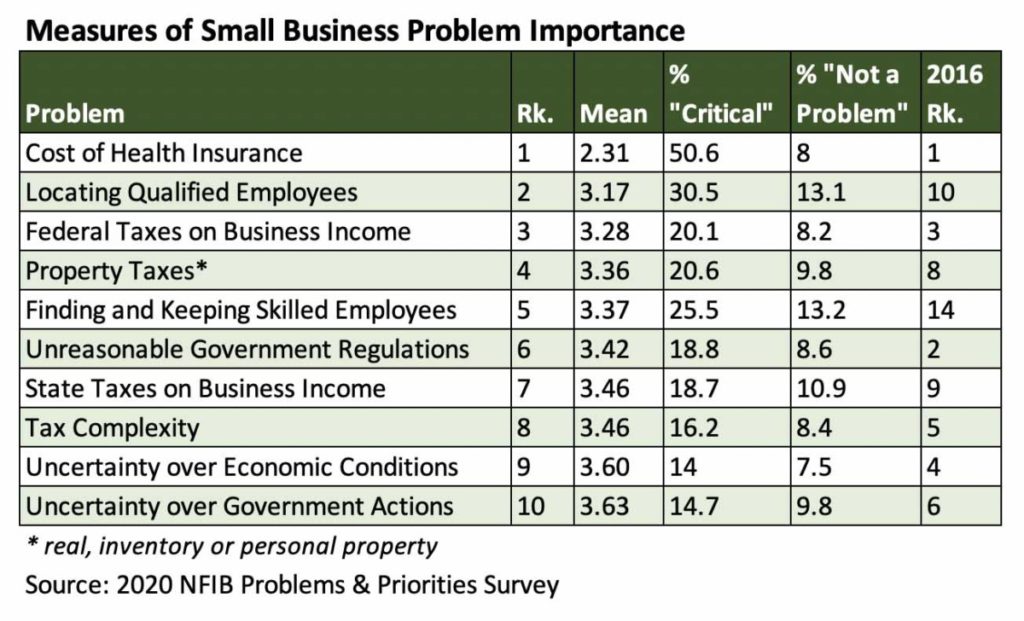

The National Federation of Independent Business (NFIB) Research Center has provided a comprehensive view of these issues for nearly 40 years in their quadrennial Problems & Priorities Survey. Respondents are asked to rank dozens of potential business problems from 1 to 7, with 1 representing “Not a Problem” and 7 signaling a “Critical Problem.”

And the 2020 edition, based on responses from 2,552 NFIB-member respondents in February and March, shows that before the onset of the global pandemic, many things changed … but some remained stubbornly consistent.

The following are several key findings of the 2020 NFIB Problems & Priorities Survey to help you better understand some of the biggest problems facing small businesses today.

Small Businesses’ 10 Biggest Problems in 2020

First, let’s take a snapshot look at what respondents most uniformly called their most pressing issues as of 2020’s pre-COVID months. Then we’ll dig into some of the individual issues.

Health Insurance’s Reign Continues

Small business owners have been concerned with the cost of health insurance for some time. That No. 1 ranking didn’t just go unchanged from 2016’s study. It has persisted for 29 years, according to the NFIB.

It’s not just any old problem, either. A little more than half of respondents list this issue as “Critical,” effectively unchanged from last year.

“Despite the slowing rate of premium increases, the percent who find it a critical problem continues to overshadow the second highest ranking problem, ‘Locating Qualified Employees,’ by 20 percentage points,” the NFIB writes.

It’s Harder to Find the Right Employees

The two biggest upward jumps in 2020 were both related to staffing: Locating Qualified Employees (No. 2, up from No. 10 in 2016), and Finding and Keeping Skilled Employees (No. 5, up from No. 14 four years ago).

Historically low unemployment rates contributed significantly to these issues, so it’s fair to speculate whether these issues are nearly as prevalent in the second half of 2020 — with unemployment still in double digits as of July — as they were at the beginning of the year.

Nonetheless, the NFIB points out that being unable to find properly skilled employees can be a drain on small businesses, who often have to “devote more time and resources to train current employees or those newly hired.”

Taxes, Taxes, Taxes

As far as small business problems go, no single tax concern rises above health insurance costs in severity. The NFIB points out that’s “certainly due to the passage of the 2017 Tax Cuts and Jobs Act that significantly lowered and simplified federal taxes for most small-business owners.”

Nonetheless, four different tax categories remained within small business’ 10 biggest problems. And business owners’ concerns aren’t limited to how much they must pay the IRS.

The No. 8 problem listed in the NFIB’s report was “Tax Complexity,” with 16% considering it a “Critical” problem, but “Frequent Changes in Federal Tax Laws and Rules” also came in at No. 13 — down from 17 four years ago thanks to simplifications from the TCJA, but still viewed as a “Critical” issue by nearly 11% of respondents.

Small business taxes remain exceedingly difficult. It’s no wonder then, that the NFIB observes “88 percent of owners use a tax preparer and their main reason in doing so is to ensure compliance.”

The good news is that the right tax preparer can make a world of difference in alleviating several of these small business problems. For instance, McManamon & Co.’s tax services for small and midsized businesses include:

- Tackling federal and state obligations, as well as payroll taxes

- Helping companies meet compliance requirements

- Minimizing and deferring pending liabilities

We can’t cure every issue your small business faces right now. But we can take several of the bricks off your shoulders, and potentially save you money. Call us at 440.892.8900 or contact us online today.

Tags: healthcare, McManamon & Co., small business, small business finances, small business taxes, taxes | Posted in Healthcare, small business, small business taxes, taxes