When Is It Time to Change Your Business Structure?

Choosing a business structure is one of the first major decisions an entrepreneur makes. And we want to stress...

Read More

Choosing a business structure is one of the first major decisions an entrepreneur makes. And we want to stress...

Read More

When tax season rolls around, many individuals and business owners alike face the same question: “Do I need a...

Read More

The tax code is constantly in a state of flux, which is why staying compliant is such a headache....

Read More

The 2025 tax year rang in a major (albeit temporary) tax change for many workers, especially those who earn...

Read More

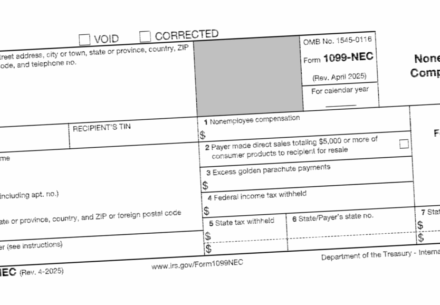

If your business relies on contractors and freelancers, you’re not alone. Millions of Americans working independently help companies fill...

Read More

Big tax changes don’t come around every year, but when they do, they can be confusing, controversial and have...

Read More

Washington has just passed one of the most significant pieces of tax legislation in decades. The One Big Beautiful...

Read More

Millions of Americans have straightforward tax filings, but some individual taxpayers and many business owners weave a much more...

Read More

The tax code is constantly in a state of flux, which is why staying compliant is such a headache....

Read More

Tax planning is usually associated with the final months of the year — a time when business owners gather...

Read More