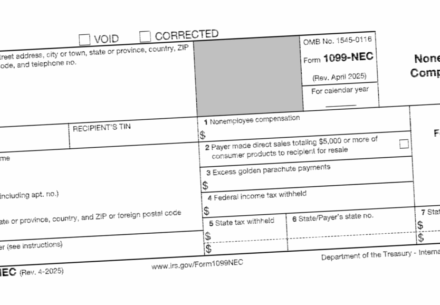

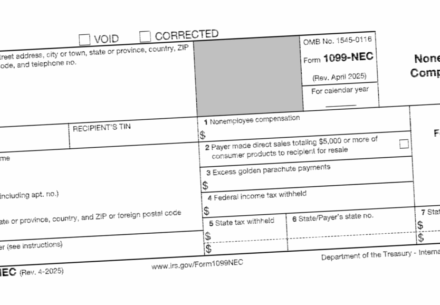

How Businesses Must Handle 1099s for Contractors & Freelancers

If your business relies on contractors and freelancers, you’re not alone. Millions of Americans working independently help companies fill...

Read More

If your business relies on contractors and freelancers, you’re not alone. Millions of Americans working independently help companies fill...

Read More

Washington has just passed one of the most significant pieces of tax legislation in decades. The One Big Beautiful...

Read More

We say it often, but it bears repeating: For many small business owners, every dollar counts. Yet in their...

Read More

Millions of Americans have straightforward tax filings, but some individual taxpayers and many business owners weave a much more...

Read More

The tax code is constantly in a state of flux, which is why staying compliant is such a headache....

Read More

Small businesses have had to operate in shifting environments over the past few years, but one thing has remained...

Read More

Starting a new business is exhilarating, but the thrill of entrepreneurship often comes with a steep learning curve. For...

Read More

Tax planning is usually associated with the final months of the year — a time when business owners gather...

Read More

As a tax professional, your success relies on keeping up with the latest tax law changes, industry trends and...

Read More

“No taxes on tips.” It’s rare that you hear the same messaging on both sides of the aisle, and...

Read More