Tax Changes Coming to the Table in 2026

The tax code is constantly in a state of flux, which is why staying compliant is such a headache. Every year, small business owners who do their own taxes have to catch up with the latest rule additions, phase-outs and expirations pertaining to deductions, credits and more.

Our advice? Don’t play catch-up; instead, be proactive. That means not just staying on top of the latest tax changes, but keeping an eye on potential tax discussions and decisions that could turn into new policy.

This advice carries even more weight in 2026, just a few months removed from Washington passing a massive budget reconciliation bill with a raft of tax consequences, including making permanent several tax rules from the Tax Cuts and Jobs Act (TCJA) and adding some temporary deductions.

Today, we want to shine a light on some of the most important tax changes that Americans should be aware of as we enter 2026.

2026 Changes

2026 Tax Brackets

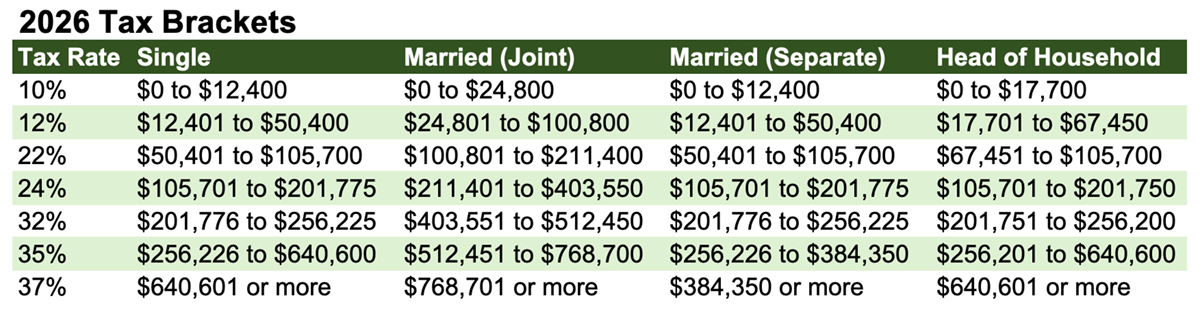

First things first: The federal tax brackets have largely been expanded to reflect changes in inflation. Here’s a look at the 2026 tax brackets, which apply not just to individual taxpayers, but also several business structures, including sole proprietorships, partnerships and S corps.

2026 Standard Deductions

Standard deductions will also be larger in 2026:

- Single and married filing separately: $16,100 (up $350 from 2025)

- Married filing jointly: $32,200 (up $700 from 2025)

- Heads of household: $24,150 (up $525 from 2025)

All comparisons are to the final 2025 standard deductions following passage of the budget reconciliation bill, which allowed for higher standard deductions than what were announced before the start of 2025.

2026 Retirement Plan Contribution Limits

The 2026 contribution limit for 401(k)s, which also applies to 403(b)s and 457s, is $24,500, up from $23,500 in 2025.

Older workers can make “catch-up” contributions, too.

- Anyone age 50 to 59 or 64 and older can make up to $8,000 in additional contributions, for a total of $32,500.

- Anyone age 60 to 63 can enjoy an even higher contribution limit of $11,250 (for a total limit of $35,750).

Individual retirement account (IRA) limits were raised from $7,000 in 2025 to $7,500 in 2026. IRAs’ catch-up contribution limits also were improved, by $100, to $1,100 (for a total limit of $8,600).

Important Tax Changes for 2026

Most of the tax “changes” taking place in 2026 are changes that the OBBB brought into existence in 2025, and many of those were applied retroactively to 2025. Still, the changes are significant, and the current tax season (for 2025 returns) is the first time taxpayers will be dealing with them, so they’re worth a closer look here.

New Senior Deduction

The OBBB created a “senior deduction” of up to $6,000 per eligible senior, or up to $12,000 per eligible married senior couple (if they file jointly).

This deduction has a “phase-out” that begins once your modified adjusted gross income (MAGI) exceeds $75,000 if you’re a single or head-of-household filer, or $150,000 if you’re a married couple filing jointly or surviving spouse. The deduction becomes fully phased out once your MAGI exceeds $175,000 if you’re a single or head-of-household filer, or $250,000 if you’re a married couple filing jointly or surviving spouse.

This deduction can be taken whether you itemize or take the standard deduction. However, it expires after the 2028 tax year.

New Tax Deduction for Tips

Filers can deduct up to $25,000 in cash tips, phasing out between MAGI of $150,000 for single filers and $300,000 for joint filers, and completely phased out at MAGI of $400,000 for single filers and $550,000 for joint filers. The deduction, which you can take regardless of whether you take the standard deduction or itemize, will apply to occupations to be released later this year. This is also temporary, expiring in 2028.

New Tax Deduction for Overtime Pay

The OBBB also created a similar temporary “no tax on overtime pay” deduction until the 2028 tax year. The deduction is for up to $12,500 in overtime pay for single filers, $25,000 for married couples filing jointly. The phase-out begins at a MAGI of $150,000 for single filers and $300,000 for married couples filing jointly, and the deduction is fully phased out at MAGI of $275,000 for single filers and $550,000 for joint filers. This also can be taken regardless of whether you itemize or take the standard deduction.

Immediate R&D Expensing Returns

One of the less celebrated but highly disruptive Tax Cuts and Jobs Act (TCJA) changes was the requirement, starting with the 2022 tax year, to amortize domestic research and development (R&D) expenses over five years rather than deducting them in the year they were incurred.

However, the OBBB has reinstated immediate R&D expensing. In other words, domestic R&D expenses become fully deductible in the year in which those expenses occurred. Also, companies will be able to amend their returns for 2022 through 2024 to recover amortized costs.

Business Interest Deductions Get a Boost

The OBBB also reverted the business interest deduction limitation to a more favorable calculation. Specifically, starting with the 2022 tax year, taxpayers couldn’t add back depreciation and amortization in determining adjusted taxable income. However, with the passage of the OBBB, the EBITDA-based interest deduction limitation was restored starting in the 2025 tax year — meaning taxpayers can add back depreciation and amortization when determining adjusted taxable income.

Let Us Keep Tabs on Taxes for You

Of course, small business owners have a lot on their plates. They typically don’t have time to keep up with the rapidly changing tax landscape, let alone look ahead to mere discussions and speculation on tax policy.

But with McManamon & Co. on your side, you don’t need to.

We provide proactive tax advice that keeps your company on Uncle Sam’s good side. Our tax strategies incorporate vigilance and forward planning to keep you in control of your tax situation. We routinely project upcoming tax liabilities and make recommendations to minimize and defer pending liabilities.

If you want to make sure your company is always prepared for what the IRS throws your way, call us at 440.892.8900 or contact us online.

Tags: McManamon, small business, small business taxes, tax changes, taxes | Posted in McManamon & Co., small business, taxes